Pulled from the archives, this post was originally published August 14, 2012.

Denver Bailey, Purdue Alumnus

www.purdue.edu/mymoney

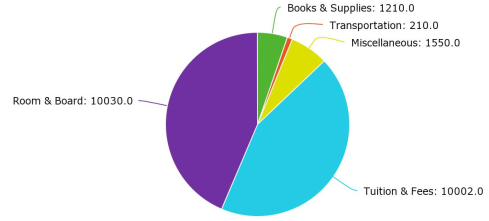

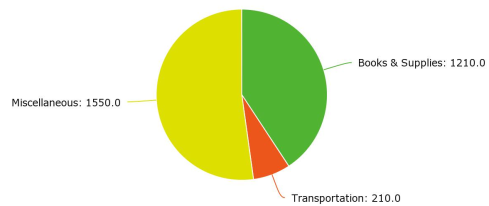

Are you having trouble deciding to live on or off campus? This is one of the most important decisions you will make for the academic year. Where you choose to stay for the year will decide how much loan or aid you will need for the year, but you don’t want to choose your housing based on price. You want to make sure to choose the proper housing for your budget and your lifestyle.

Residence halls tend to be the first choice for first year students. They are typically on campus and within a short walk to class. This means you can sleep in later, and as most college students know, every minute of sleep counts. The dining courts are open periodically throughout the day and having your food prepared for you can save more time for studying. Before selecting a resident hall, do some further research to find out which one is best suited for you. Click here for a closer look at the resident halls on Purdue University’s campus.

Renting an apartment or a house can be a wise decision for someone who is looking for a little more responsibility, personal space, and a chance to keep some cash in their pocket. With the money I saved living off campus, I was able to stay year round versus the typical 9 months students stay living in the dorms. Trust me, not moving my things twice a year was a bonus. I had to make sure I chose the best possible place and with apartments, it is all about location, location, location, and benefits. Typically, the farther you go from campus, the more affordable the apartment is going to be. However, if you go too far you might end up paying more in gas and you might have to buy a parking pass. Ensure you’ll make it on time by finding an apartment that offers free transportation or is at least located on the CityBus route. You may not be able to find an apartment that offers 3 meals a day and unlimited soft drinks like the Purdue dining halls, but you can find apartments with swimming pools, gyms, and movie theatres. Before you sign a lease, make a list of benefits you would like to have in an apartment and then visit BoilerApartments to get a closer look at apartment options in the local area.

While off-campus living gives you more personal space, Residence halls are filled with many other students. Sometimes those students even share the same major as you. This creates an open door for group study. The residence halls give a close network with many possibilities for mentoring and friends. I lived in a residence hall my first year, and I didn’t like the experience of sharing a room with another person. There are many things I had to adjust to while living in the residence hall. For example: Residence halls only have community showers. But, my first friends on campus were people I met just walking around the halls, and these people are still my friends today. Before you jump to sign a lease, make sure you can make friends and build a network in the off-campus environment. Joining clubs and getting involved in extracurricular activities on campus help everyone develop socially.

Before settling on a residence hall or renting somewhere off-campus, determine what is important to you and create a budget for housing and food. Some people will spend their whole time at Purdue in a Residence Halls because living in an apartment is just not for them. Some people will never live on campus because it doesn’t fit in their budget. It really breaks down to the small things that matter to you.

After you calculate how much money you can budget for housing, complete the following housing test by agreeing or disagreeing to the statements. There’s a lot of other factors to consider when choosing your housing situation, of course, but these are just some starting questions to consider when starting the decision-making process.

1. I prefer sleeping in.

2. I would rather walk to class.

3. I can (or will learn to) cook.

4. I have transportation to late classes/evening exams.

5. I don’t mind sharing a room with a person I have never met.

6. I am/will be involved in clubs/activities.

7. I would like to have a pet.

8. I will be working throughout the year to pay for my housing.

9. I am comfortable with community showers.

10. I plan on taking summer classes.

If you agreed with numbers 1, 2, and/or 9 then you may prefer living on-campus in a residence hall

Numbers 5, 6, 8 can go either way, but should be factors when deciding where you’ll live: is it really convenient for you to have to drive in every day/rely on a bus? Would you rather live with a bunch of friends or by yourself?

If you agreed with numbers 3, 4, 7, and/or 10 then you may prefer living off-campus (especially if you want to have a pet).